Post Syndicated from Ainesh Arumugam original https://blog.cloudflare.com/ethereum-merge-and-testnet-gateways/

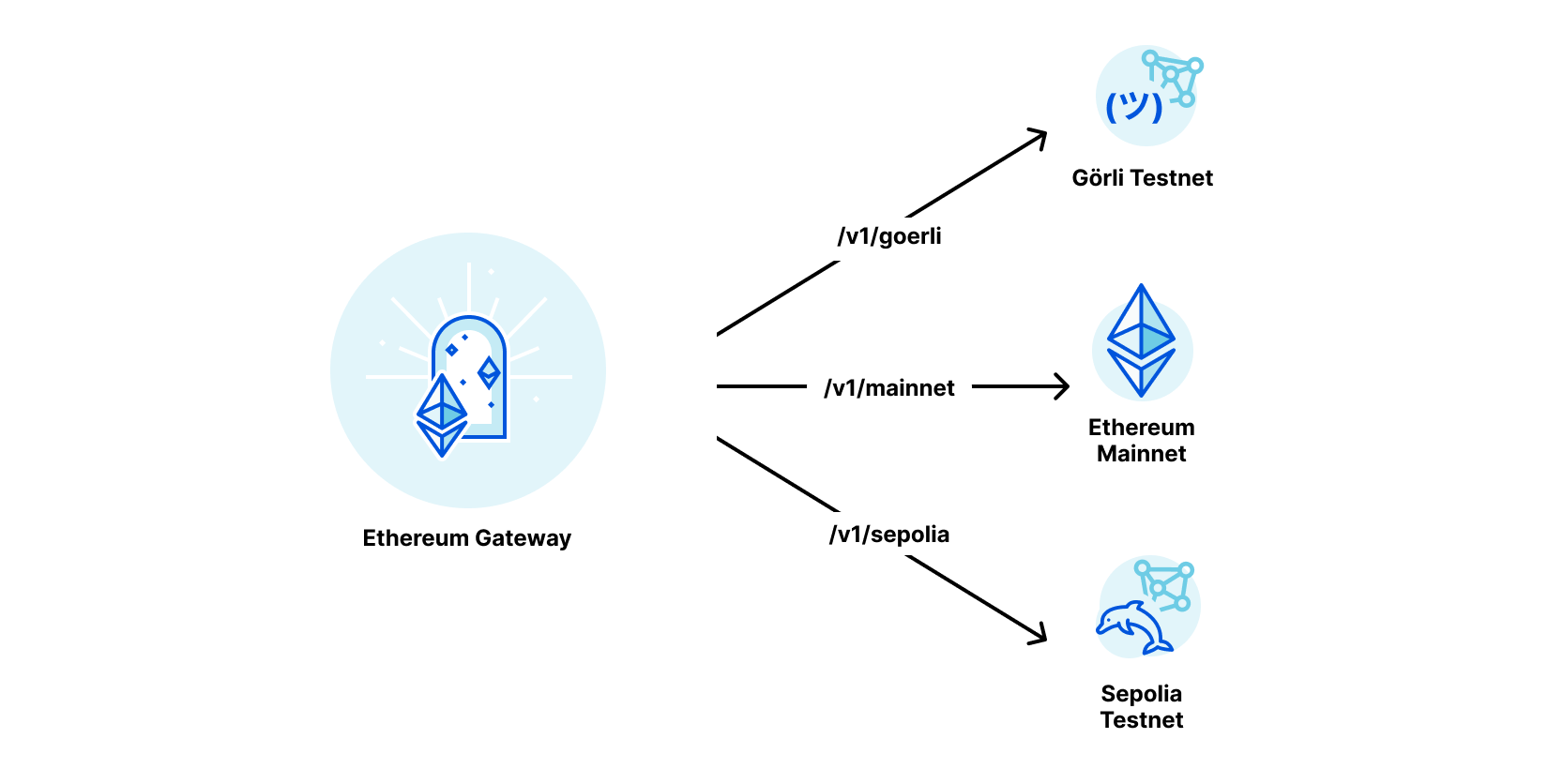

Today we are excited to announce support for the Ethereum Merge on the Ethereum network and that our Ethereum gateways now support the Görli and Sepolia test networks (testnets). Sepolia and Görli testnets can be used to test and develop full decentralized applications (dapps) or test upgrades to be deployed on the mainnet Ethereum network. These testnets also use the Ethereum protocol, with the major difference that the Ether transacted on the testnet has no value.

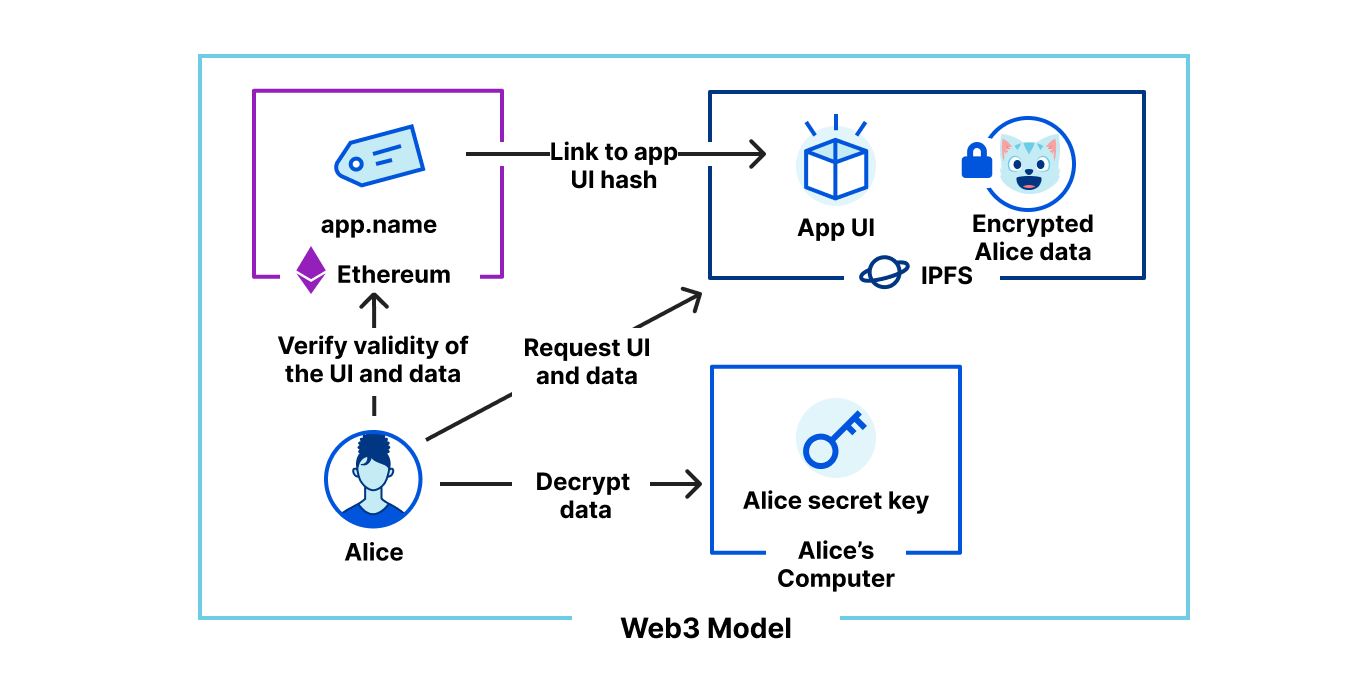

Ethereum is a decentralized blockchain with smart contract functionality which Cloudflare allows you to interact with through an HTTP API. For a quick primer on Ethereum and our gateway, please refer to our previous blog post on the Ethereum Gateway.

As preparation for the merge, the Ethereum Foundation has executed merges on multiple testnets to ensure that the actual mainnet merge will occur with minimal to no disruption. These testnets both successfully upgraded to Proof of Stake and Proof of Authority, respectively. Cloudflare’s Testnet Gateway handled the Görli-Prater merge without issue, ensuring that we will be ready and prepared for the upcoming Ethereum Merge for mainnet. Our testnet gateways are live and ready for use by Cloudflare Ethereum Gateway customers.

In this blog, we are going to discuss the consensus transition entailed by the Ethereum Merge, changes in the Cloudflare Ethereum Gateway, and how you can start using them today.

Consensus Mechanisms

Proof of Work is the original consensus mechanism of the Ethereum blockchain, popularized by Bitcoin. Miners compete to be the first to solve the puzzle, allowing them to update the blockchain with the latest transactions and receive a reward in exchange. The more miners and more processing power focused on solving these puzzles, the more secure the network. While this was first thought to help decentralization as it could be run on commodity hardware, users started to run highly powerful computer hardware, like ASICs and GPUs, to solve these complex math puzzles. This means the security of the network comes with a massive tradeoff. This massive network of Ethereum miners consume more than 80 terawatt Hours per year – more than the country of Chile. Clearly, this is not a sustainable mechanism for consensus, especially as use of cryptocurrency and web3 technologies becomes more widespread.

Proof of Stake is a consensus mechanism that lets users that have staked a specified amount of cryptocurrency run nodes to propose and validate blocks and receive a cryptocurrency reward. These nodes, commonly referred to as validators, are responsible for keeping the network secured and progressing. For every slot, one random validator node is chosen to be the proposer and a committee of random validator nodes is chosen to validate the proposed block. In the case of validators acting dishonestly or being unavailable, the validator will be penalized economically by having their stake “slashed”. Proof of Stake is significantly more sustainable – the Ethereum Foundation estimates that it will consume 99.95% less electricity than Proof of Work. Plus, it comes with the additional benefit that validators have a financial incentive to uphold the health of the blockchain.

Proof of Authority is very similar to Proof of Stake, as validators propose and validate blocks to progress their blockchain. However, a significant difference is that nodes can only become validators if they’re approved by an authority node, instead of putting up a stake. Cloudflare currently runs one such authority node for the now-deprecated Rinkeby testnet. This is a fairly uncommon consensus algorithm for public blockchains in comparison to Proof of Work and Proof of Stake, but is commonly used in trusted communities like internal networks for corporations and governments.

Cloudflare Ethereum Gateway

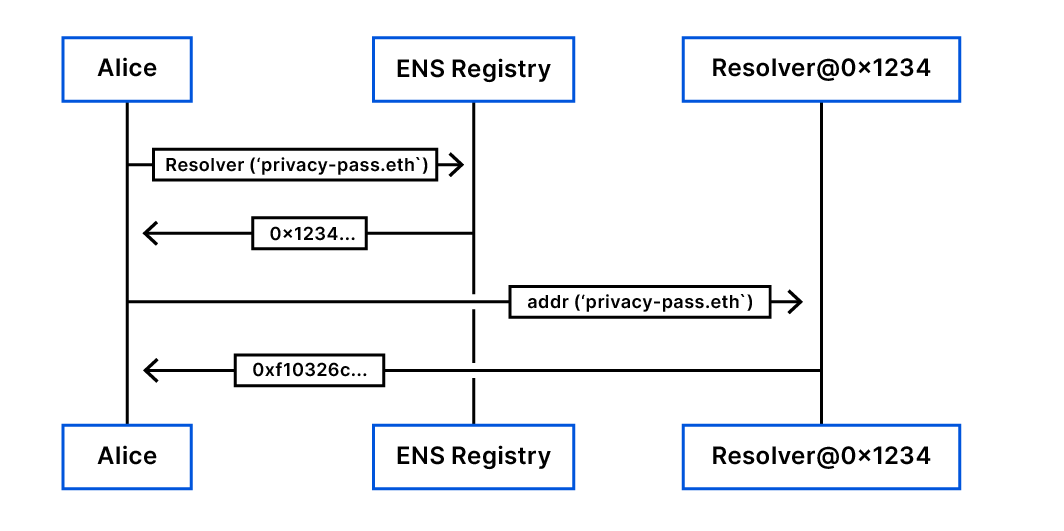

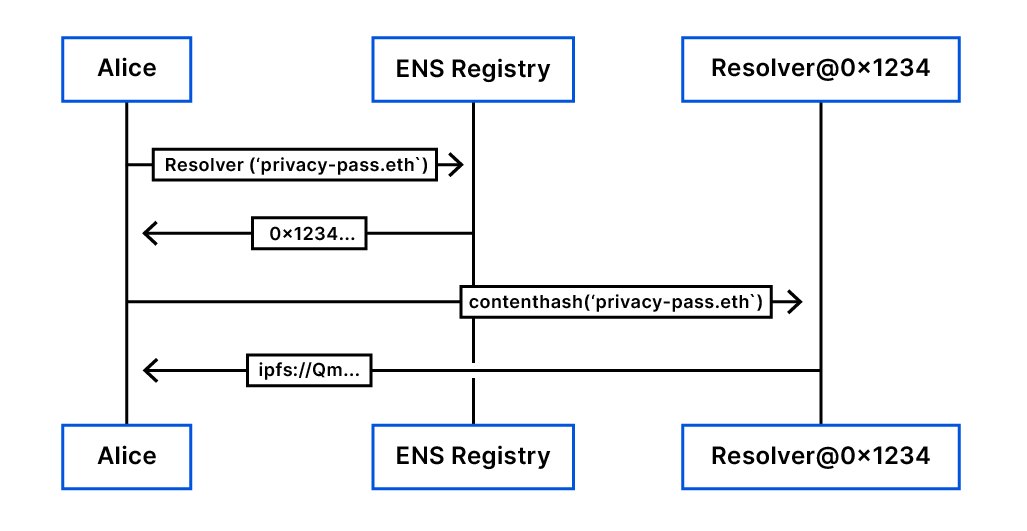

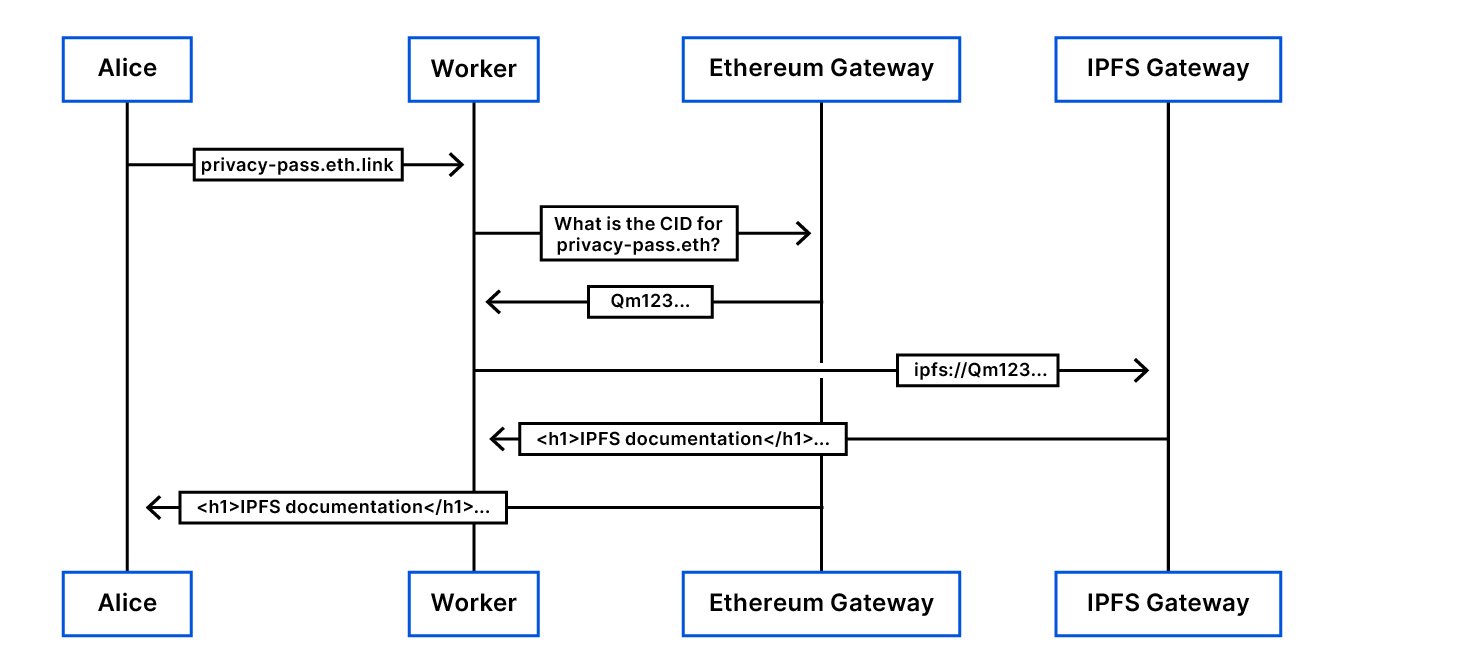

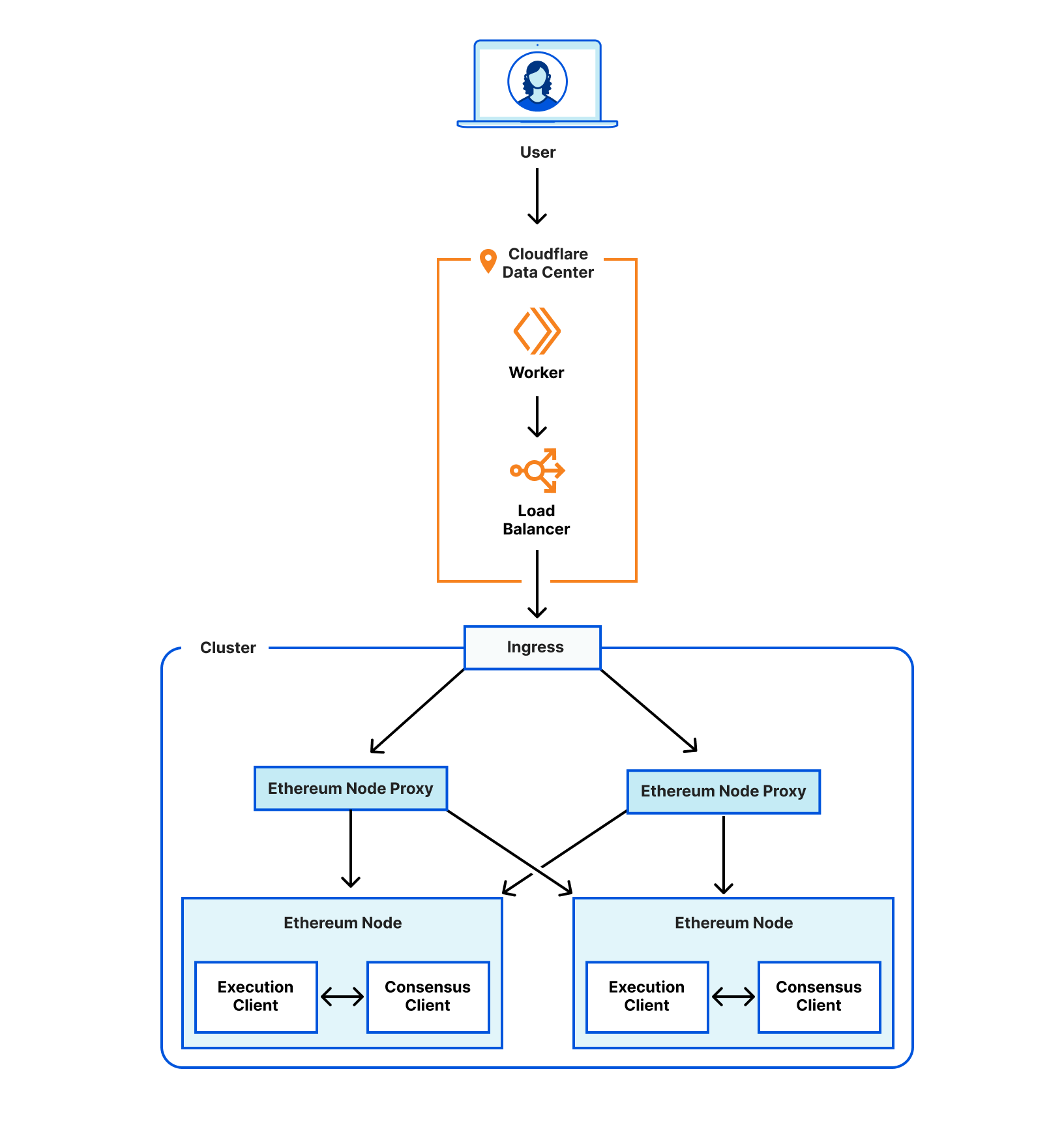

At Cloudflare, we believe in using our own technologies to build our products, and the Ethereum Gateway is no exception. The Ethereum Gateway allows any customer to interact with the Ethereum network without needing to run their own dedicated node. A JSON-RPC call is first received by a Worker, serverless code deployed in all of our data centers, ensuring that queries from any geographic region are processed quickly, and that requests are normalized using the latest block number known to the Worker.

The Worker then passes the call to a Cloudflare Load Balancer, corresponding to the specified Ethereum mainnet or testnet, which sends the call to Ethereum Node proxies inside our Kubernetes cluster. The Ethereum Node proxies queue calls and distributes them to ready and synced Ethereum Nodes that have the requested block. Our Ethereum nodes consist of an execution client and a consensus client.

The consensus client is responsible for Proof of Stake consensus, and we’ve added it to prepare the gateway for the merge. Ethereum Nodes then communicate with the specified Ethereum network to fulfill the RPC request. To ensure maximal speed, reliability, and availability, we have built in redundant Ethereum Node proxy instances and Ethereum Nodes in our cluster.

The Merge

The Ethereum Merge is a long-awaited upgrade to the Ethereum network, changing the consensus method from the current and wasteful Proof of Work protocol to a more efficient Proof of Stake protocol. The merge also opens up the door for further developments to the Ethereum network, such as sharding, which promises to speed up transactions and lower costs.

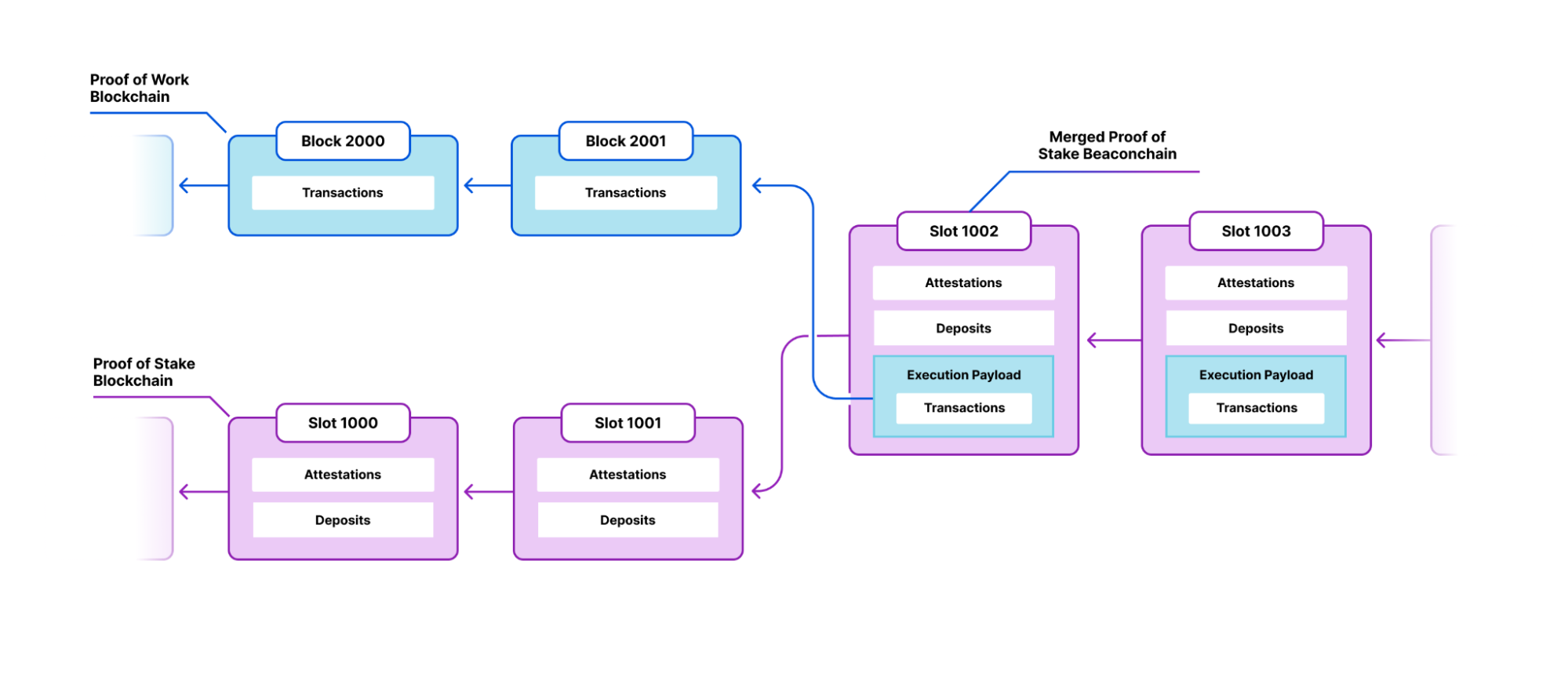

The Ethereum Merge combines the current Ethereum Blockchain with the Ethereum Beaconchain, a Proof of Stake chain, when the Terminal Total Difficulty (TTD) is hit. Once the merge is completed, the Ethereum Beaconchain will be where consensus clients will communicate to propose and validate blocks. The existing blockchain will merge with the beaconchain, linking every block after the merge to a slot on the beaconchain. The blockchain will continue to handle Ethereum transactions and smart contracts.

To prepare for the merge, a node operator must deploy a consensus client like Prysm or Lighthouse alongside their execution client. If this doesn’t occur prior to the merge, their node’s copy of the blockchain will stop syncing and the execution client will be stuck on the last block prior to the merge.

Sepolia and Görli Testnets

As per our Ethereum gateway documentation, we have made it extremely easy to send JSON-RPC calls to your preferred testnet. After you have created your Ethereum gateway, change the network in the URL from mainnet to sepolia or goerli. For example, calling eth_blockNumber to the sepolia testnet for this example gateway will look like this:

$ curl -X POST -H "Content-Type: application/json" --data '{"jsonrpc": "2.0", "method": "net_version", "params": [], "id": 35}' https://web3-trial.cloudflare-eth.com/v1/sepolia

{"jsonrpc":"2.0","result":"11155111","id":35}

This testnet support will help you ensure that your changes can be easily tested and hardened before deploying to the Ethereum Mainnet without incurring additional risk to your brand trust or product availability, all while not having to worry about operating your own infrastructure.

We want to ensure that anyone leveraging our Ethereum Gateway is able to achieve confidence and trust that whatever changes are pushed forward do not impact the end user experience. At the end of the day, the Internet is for end users and their experience and perception must always be kept within our purview at all times.

Rinkeby

As part of this announcement, we will be deprecating our Rinkeby signer with public address 0xf10326c1c6884b094e03d616cc8c7b920e3f73e0, which we operated to support the Ethereum ecosystem. We will stop Rinkeby testnet support on January 15, 2023, following the Ethereum Foundation’s move to deprecate the Rinkeby testnet.

Also, if you can’t wait to start building on our web3 gateways, check out our product documentation for more guidance.