Post Syndicated from Bruce Schneier original https://www.schneier.com/blog/archives/2021/07/disrupting-ransomware-by-disrupting-bitcoin.html

Ransomware isn’t new; the idea dates back to 1986 with the “Brain” computer virus. Now, it’s become the criminal business model of the internet for two reasons. The first is the realization that no one values data more than its original owner, and it makes more sense to ransom it back to them — sometimes with the added extortion of threatening to make it public — than it does to sell it to anyone else. The second is a safe way of collecting ransoms: bitcoin.

This is where the suggestion to ban cryptocurrencies as a way to “solve” ransomware comes from. Lee Reiners, executive director of the Global Financial Markets Center at Duke Law, proposed this in a recent Wall Street Journal op-ed. Journalist Jacob Silverman made the same proposal in a New Republic essay. Without this payment channel, they write, the major ransomware epidemic is likely to vanish, since the only payment alternatives are suitcases full of cash or the banking system, both of which have severe limitations for criminal enterprises.

It’s the same problem kidnappers have had for centuries. The riskiest part of the operation is collecting the ransom. That’s when the criminal exposes themselves, by telling the payer where to leave the money. Or gives out their banking details. This is how law enforcement tracks kidnappers down and arrests them. The rise of an anonymous, global, distributed money-transfer system outside of any national control is what makes computer ransomware possible.

This problem is made worse by the nature of the criminals. They operate out of countries that don’t have the resources to prosecute cybercriminals, like Nigeria; or protect cybercriminals that only attack outside their borders, like Russia; or use the proceeds as a revenue stream, like North Korea. So even when a particular group is identified, it is often impossible to prosecute. Which leaves the only tools left a combination of successfully blocking attacks (another hard problem) and eliminating the payment channels that the criminals need to turn their attacks into profit.

In this light, banning cryptocurrencies like bitcoin is an obvious solution. But while the solution is conceptually simple, it’s also impossible because — despite its overwhelming problems — there are so many legitimate interests using cryptocurrencies, albeit largely for speculation and not for legal payments.

We suggest an easier alternative: merely disrupt the cryptocurrency markets. Making them harder to use will have the effect of making them less useful as a ransomware payment vehicle, and not just because victims will have more difficulty figuring out how to pay. The reason requires understanding how criminals collect their profits.

Paying a ransom starts with a victim turning a large sum of money into bitcoin and then transferring it to a criminal controlled “account.” Bitcoin is, in itself, useless to the criminal. You can’t actually buy much with bitcoin. It’s more like casino chips, only usable in a single establishment for a single purpose. (Yes, there are companies that “accept” bitcoin, but that is mostly a PR stunt.) A criminal needs to convert the bitcoin into some national currency that he can actually save, spend, invest, or whatever.

This is where it gets interesting. Conceptually, bitcoin combines numbered Swiss bank accounts with public transactions and balances. Anyone can create as many anonymous accounts as they want, but every transaction is posted publicly for the entire world to see. This creates some important challenges for these criminals.

First, the criminal needs to take efforts to conceal the bitcoin. In the old days, criminals used “https://www.justice.gov/opa/pr/individual-arrested-and-charged-operating-notorious-darknet-cryptocurrency-mixer”>mixing services“: third parties that would accept bitcoin into one account and then return it (minus a fee) from an unconnected set of accounts. Modern bitcoin tracing tools make this money laundering trick ineffective. Instead, the modern criminal does something called “chain swaps.”

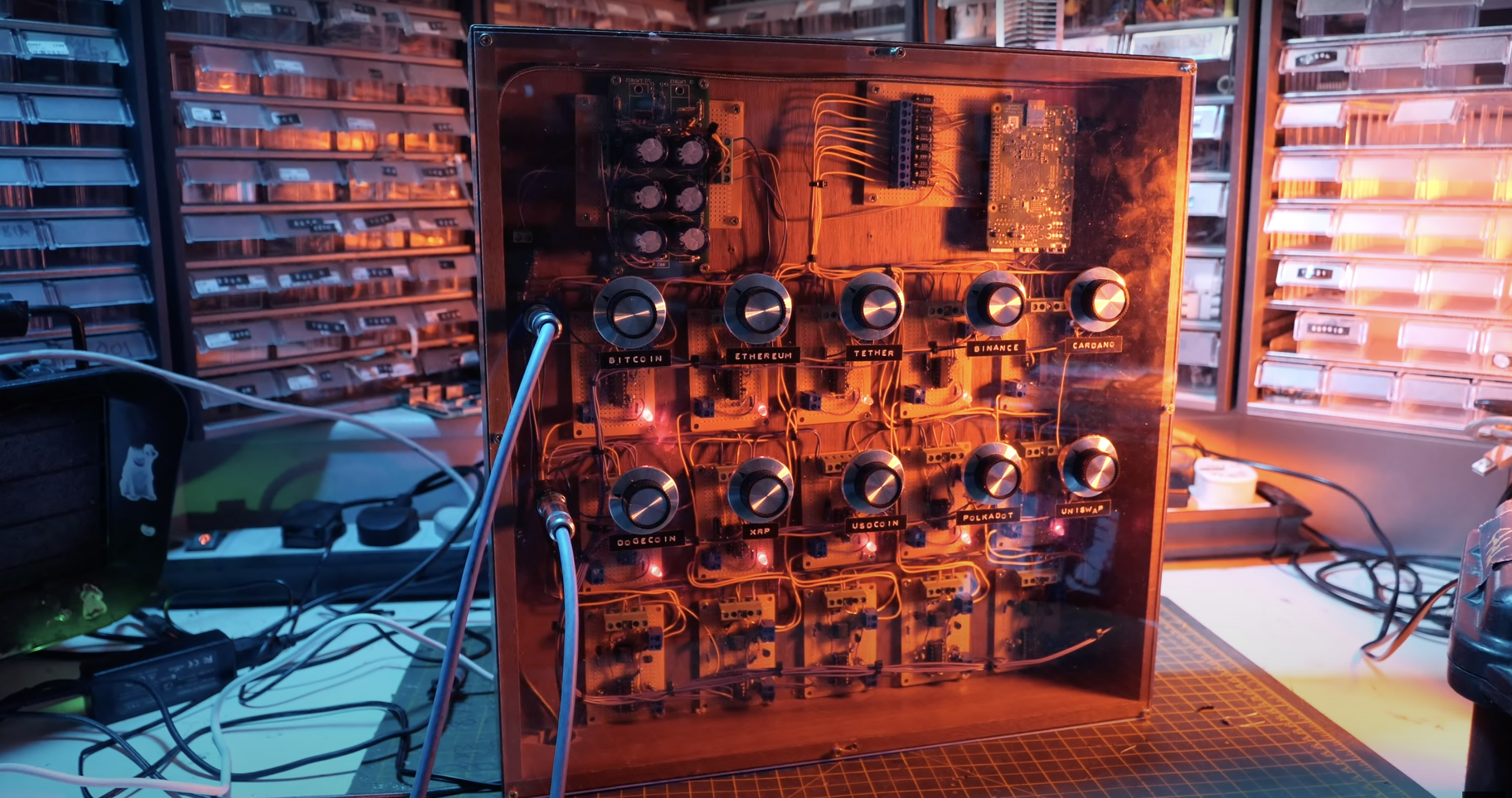

In a chain swap, the criminal transfers the bitcoin to a shady offshore cryptocurrency exchange. These exchanges are notoriously weak about enforcing money laundering laws and — for the most part — don’t have access to the banking system. Once on this alternate exchange, the criminal sells his bitcoin and buys some other cryptocurrency like Ethereum, Dogecoin, Tether, Monero, or one of dozens of others. They then transfer it to another shady offshore exchange and transfer it back into bitcoin. Voila — they now have “clean” bitcoin.

Second, the criminal needs to convert that bitcoin into spendable money. They take their newly cleaned bitcoin and transfer it to yet another exchange, one connected to the banking system. Or perhaps they hire someone else to do this step. These exchanges conduct greater oversight of their customers, but the criminal can use a network of bogus accounts, recruit a bunch of users to act as mules, or simply bribe an employee at the exchange to evade whatever laws there. The end result of this activity is to turn the bitcoin into dollars, euros, or some other easily usable currency.

Both of these steps — the chain swapping and currency conversion — require a large amount of normal activity to keep from standing out. That is, they will be easy for law enforcement to identify unless they are hiding among lots of regular, noncriminal transactions. If speculators stopped buying and selling cryptocurrencies and the market shrunk drastically, these criminal activities would no longer be easy to conceal: there’s simply too much money involved.

This is why disruption will work. It doesn’t require an outright ban to stop these criminals from using bitcoin — just enough sand in the gears in the cryptocurrency space to reduce its size and scope.

How do we do this?

The first mechanism observes that the criminal’s flows have a unique pattern. The overall cryptocurrency space is “zero sum”: Every dollar made was provided by someone else. And the primary legal use of cryptocurrencies involves speculation: people effectively betting on a currency’s future value. So the background speculators are mostly balanced: One bitcoin in results in one bitcoin out. There are exceptions involving offshore exchanges and speculation among different cryptocurrencies, but they’re marginal, and only involve turning one bitcoin into a little more (if a speculator is lucky) or a little less (if unlucky).

Criminals and their victims act differently. Victims are net buyers, turning millions of dollars into bitcoin and never going the other way. Criminals are net sellers, only turning bitcoin into currency. The only other net sellers are the cryptocurrency miners, and they are easy to identify.

Any banked exchange that cares about enforcing money laundering laws must consider all significant net sellers of cryptocurrencies as potential criminals and report them to both in-country and US financial authorities. Any exchange that doesn’t should have its banking forcefully cut.

The US Treasury can ensure these exchanges are cut out of the banking system. By designating a rogue but banked exchange, the Treasury says that it is illegal not only to do business with the exchange but for US banks to do business with the exchange’s bank. As a consequence, the rogue exchange would quickly find its banking options eliminated.

A second mechanism involves the IRS. In 2019, it started demanding information from cryptocurrency exchanges and added a check box to the 1040 form that requires disclosure from those who both buy and sell cryptocurrencies. And while this is intended to target tax evasion, it has the side consequence of disrupting those offshore exchanges criminals rely to launder their bitcoin. Speculation on cryptocurrency is far less attractive since the speculators have to pay taxes but most exchanges don’t help out by filing 1099-Bs that make it easy to calculate the taxes owed.

A third mechanism involves targeting the cryptocurrency Tether. While most cryptocurrencies have values that fluctuate with demand, Tether is a “stablecoin” that is supposedly backed one-to-one with dollars. Of course, it probably isn’t, as its claim to be the seventh largest holder of commercial paper (short-term loans to major businesses) is blatantly untrue. Instead, they appear part of a cycle where new Tether is issued, used to buy cryptocurrencies, and the resulting cryptocurrencies now “back” Tether and drive up the price.

This behavior is clearly that of a “wildcat bank,” an 1800s fraudulent banking style that has long been illegal. Tether also bears a striking similarity to Liberty Reserve, an online currency that the Department of Justice successfully prosecuted for money laundering in 2013. Shutting down Tether would have the side effect of eliminating the value proposition for the exchanges that support chain swapping, since these exchanges need a “stable” value for the speculators to trade against.

There are further possibilities. One involves treating the cryptocurrency miners, those who validate all transactions and add them to the public record, as money transmitters — and subject to the regulations around that business. Another option involves requiring cryptocurrency exchanges to actually deliver the cryptocurrencies into customer-controlled wallets.

Effectively, all cryptocurrency exchanges avoid transferring cryptocurrencies between customers. Instead, they simply record entries in a central database. This makes sense because actual “on chain” transactions can be particularly expensive for cryptocurrencies like bitcoin or Ethereum. If all speculators needed to actually receive their bitcoins, it would make clear that its value proposition as a currency simply doesn’t exist, as the already strained system would grind to a halt.

And, of course, law enforcement can already target criminals’ bitcoin directly. An example of this just occurred, when US law enforcement was able to seize 85% of the $4 million ransom Colonial Pipeline paid to the criminal organization DarkSide. That by the time the seizure occurred the bitcoin lost more than 30% of its value is just one more reminder of how unworkable bitcoin is as a “store of value.”

There is no single silver bullet to disrupt either cryptocurrencies or ransomware. But enough little disruptions, a “death of a thousand cuts” through new and existing regulation, should make bitcoin no longer usable for ransomware. And if there’s no safe way for a criminal to collect the ransom, their business model becomes no longer viable.

This essay was written with Nicholas Weaver, and previously appeared on Slate.com.